验证过程

You might see a note on your Student Aid Report saying you’ve been selected for verification; or our office might contact you to inform you that you’ve been selected.

验证 is the process schools use to confirm that the data reported on your FAFSA is accurate. 在线博彩's 金融援助 Office has the authority to contact you for documentation that supports the information you reported on your FAFSA.

If you’re selected for verification, don’t assume you’re being accused of doing anything wrong. Students are selected at random by the Department of Education. All you need to do is provide the documentation our office asks for—and be sure to do so by the published deadline (see below), or you won’t be able to get financial aid prior to the payment deadline. To determine which documents are required, please log in to your OneLogin account and review your "Eligibility Requirements" within the 金融援助 section; instructions can be viewed below. You can now submit and sign forms electronically!

Instructions for Reviewing Outstanding Requirements:

- Review your myuwg email address frequently for notifications of missing requirements

- 登录到您的 OneLogin account to view outstanding requirements

- 搜索 for “金融援助 验证” in the search box and click the ‘金融援助 验证’ tile.

- Sign in to the new screen that appears with your full OneLogin email address and your OneLogin password.

- If prompted to confirm your information, please enter it 完全 as it appears on your FAFSA.

- 完成所有未完成的文件

在线博彩的优先文件截止日期:

- 秋季学期- 7月1日

- 春季学期- 11月1日

- 夏季学期- 4月1日

IRS数据检索工具:

If you used the Internal Revenue Service Data Retrieval Tool (IRS DRT) when filling out your FAFSA, and you have not changed any of the information retrieved, you will not have to verify that information. If you didn’t use the IRS DRT and you’re selected for verification, log back in at studentaid.政府 to see whether you can use IRS DRT to fill in the relevant fields on your FAFSA. If not, the 金融援助 Office will require you to submit an 美国国税局纳税申报表 as part of the verification process. You can find your tax transcript through the IRS’s 获取成绩单服务; detailed instructions linked below. Watch the video or view the example below if you have questions about requesting your 美国国税局纳税申报表. Please note that an 美国国税局纳税申报表 is the only transcript type that can be accepted.

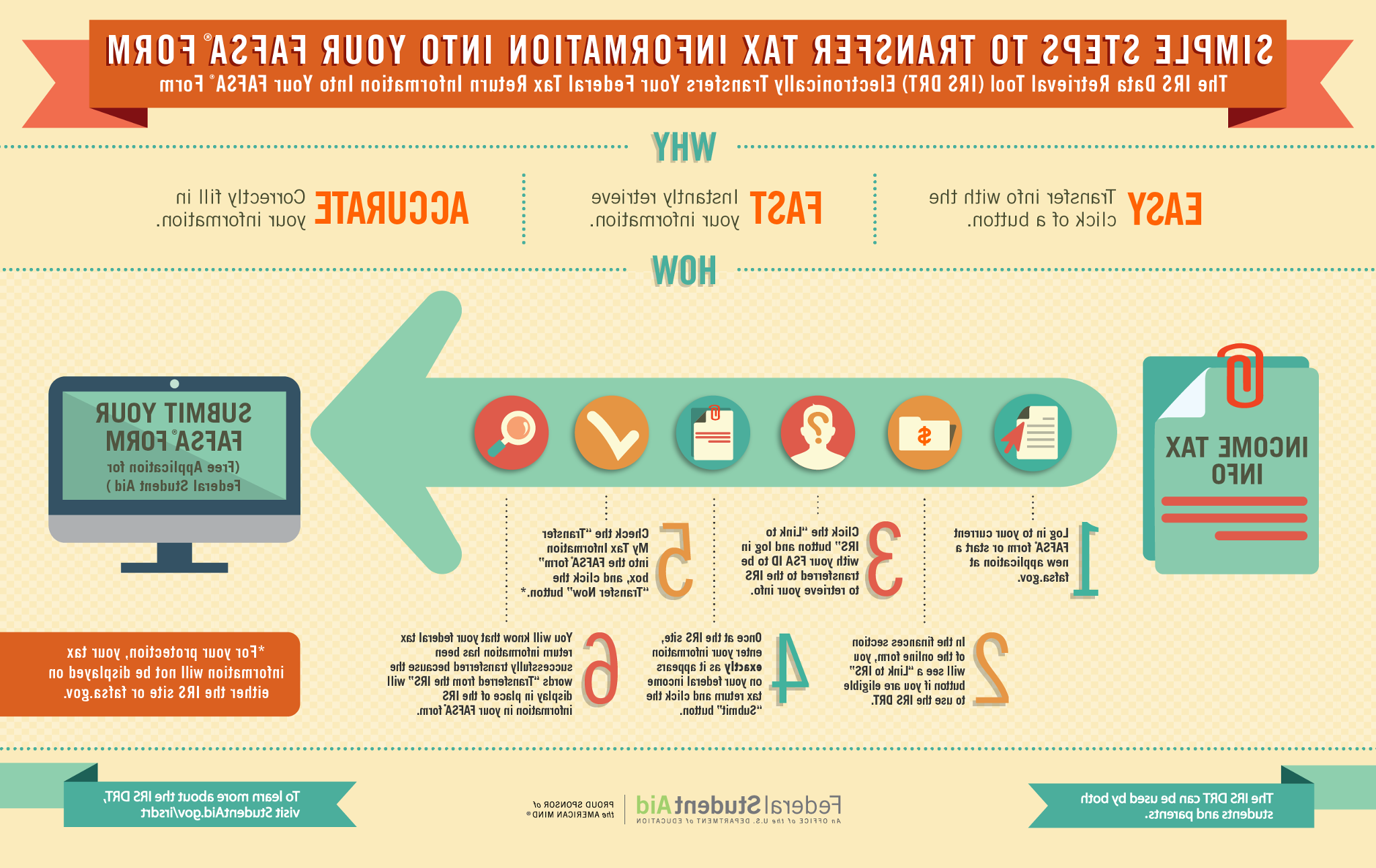

The IRS Data Retrieval Tool is available on the 2021-2022 FAFSA! Please see the steps below on transferring your tax information into the FAFSA!

为什么

- 容易: Transfer info with the click of a button.

- 快: Instantly retrieve your information.

- 准确的: Correctly fill in your information.

如何

- Log in to your current FAFSA* form or start a new application on the 联邦学生援助网站.

- In the finances section of the online form, you will see a "Link to IRS" button if you are eligible to use the IRS DRT.

- Click the "Link to IRS" button and log in with your FSA ID to be transferred to the IRS to retrieve your info.

- Once at the IRS site, enter your information 完全 as it appears on your federal income tax return and click the "Submit" button.

- Check the "transfer My Tax 信息 into the FAFSA form" box and click the "Transfer Now" button.

- You will know that your federal tax return information has been successfully transferred because the words "transferred from the IRS" will display in place of the IRS information in FAFSA form.

*For your protection, your tax information will not be displayed on either the IRS site or fafsa.政府.

The IRS DRT can be used by both students and parents.

To learn more about the IRS DRT, visit the 联邦学生援助网站.

资源

身份盗窃受害者

If you or your parents have been victims of documented identity theft and cannot get a return transcript or use the DRT, you may request and submit a Tax Return DataBase View (TRDBV) transcript as well as a statement they have signed and dated indicating that they were victims of tax-related identity theft and that the IRS has been made aware of it. They do this by calling the IRS’s Identity Protection Specialized Unit (IPSU) at (800) 908-4490. After the IPSU authenticates the tax filer’s identity, he/she can ask the IRS to mail the TRDBV transcript, which is an alternate paper transcript that will look different than a regular transcript but is official and can be used for verification. Those who cannot obtain TRDBV transcript may instead submit another official IRS transcript or equivalent IRS document, but it must include all of the income and tax information required to be verified by the school.